77+ pages problem 4 4 using t accounts to analyze transactions answers 2.1mb. Problem 16E from Chapter 4. Analyzing Business Transactions Using T Accounts Review. What you are going to learn Slide 4 Basic Accounting Equation as a HUGE T-Account So What. Read also analyze and learn more manual guide in problem 4 4 using t accounts to analyze transactions answers Fast Facts Approximately 70 of sales are derived from productsbusinesses that have a 1 or 2 global market share position As portions of the.

Problem 4-4 Using T Accounts to Analyze Transactions Due Nov 11 2016 by 2159. The sale would be entered on the left increase side of an asset account.

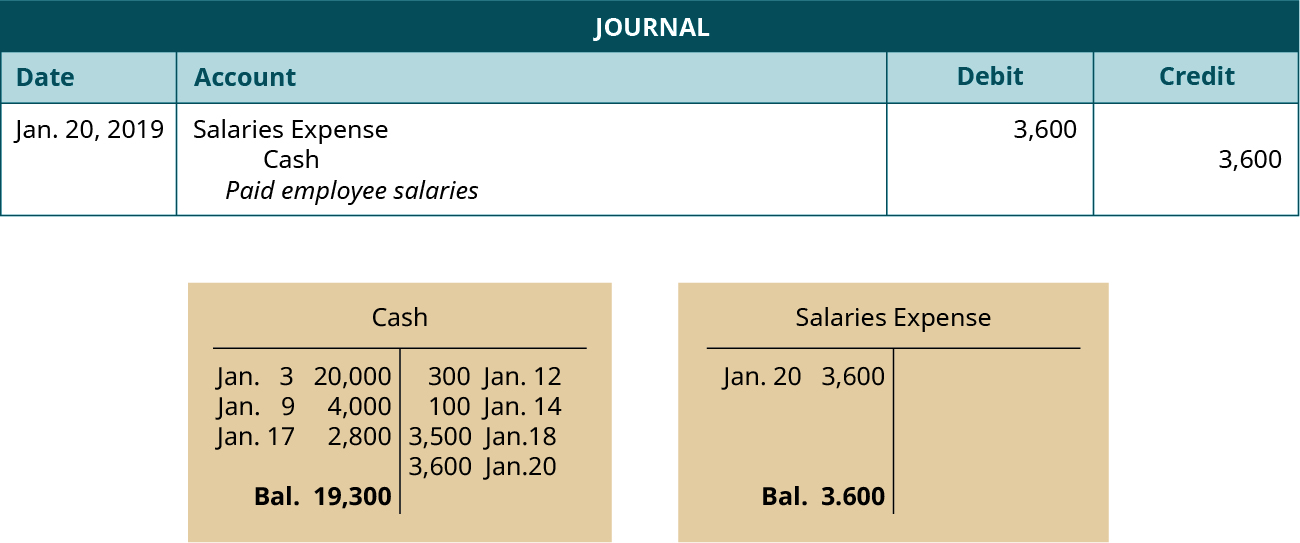

4 4 Preparing Journal Entries Financial Accounting

| Title: 4 4 Preparing Journal Entries Financial Accounting |

| Format: eBook |

| Number of Pages: 187 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: April 2017 |

| File Size: 2.3mb |

| Read 4 4 Preparing Journal Entries Financial Accounting |

|

Problem 42 Alice Roberts uses the following accounts in her business.

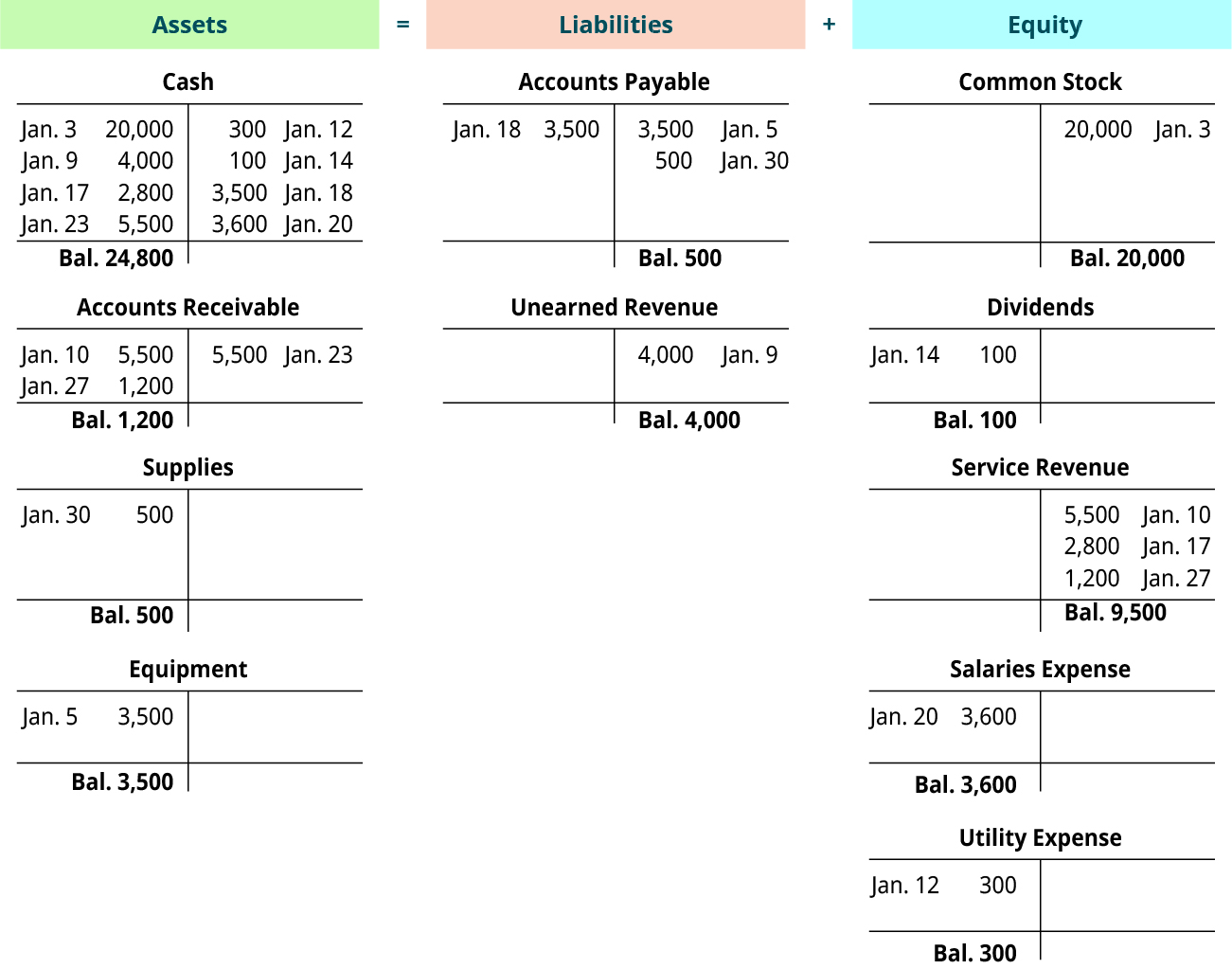

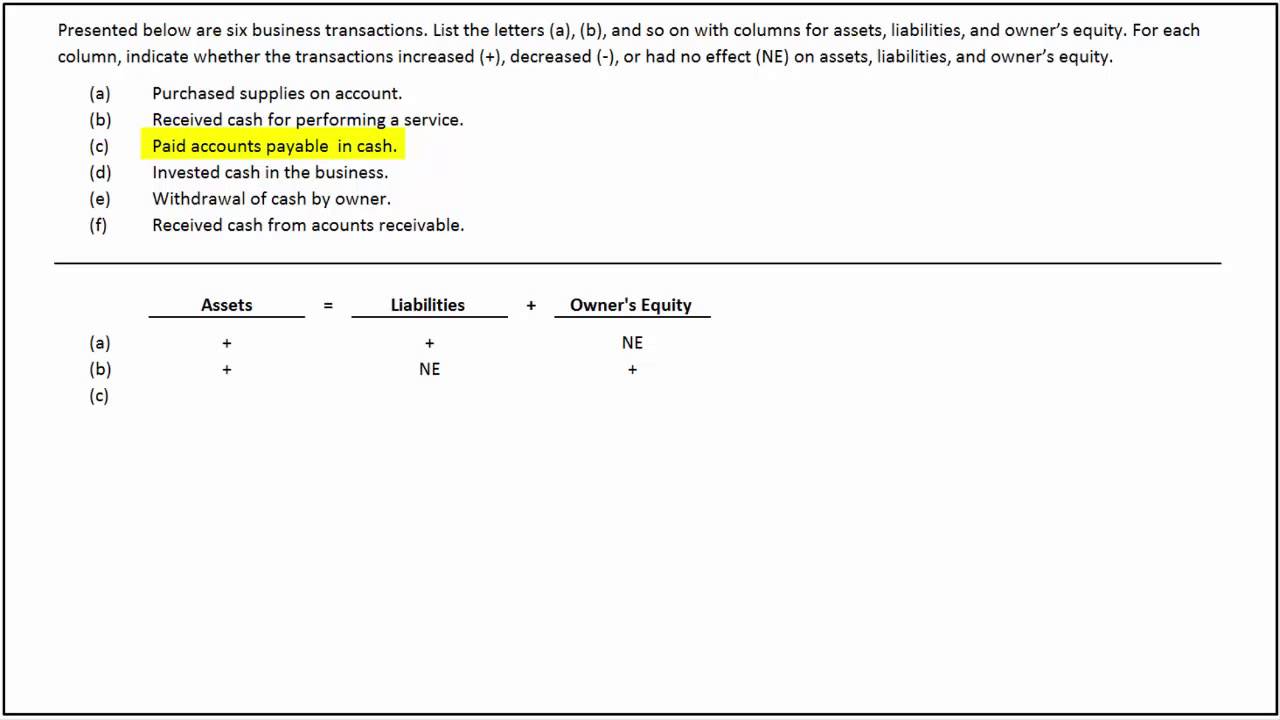

Assets Equities Property. Deductions to account balances should be indicated by a minus sign 1. We have solutions for your book. T- accounts are helpful when analyzing transactions. Analyze each of the following transactions. On-screen Show Other titles.

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

| Title: Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

| Format: PDF |

| Number of Pages: 159 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: December 2021 |

| File Size: 6mb |

| Read Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

|

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

| Title: Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

| Format: eBook |

| Number of Pages: 343 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: January 2021 |

| File Size: 2.6mb |

| Read Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

|

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

| Title: Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

| Format: PDF |

| Number of Pages: 276 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: May 2021 |

| File Size: 5mb |

| Read Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

|

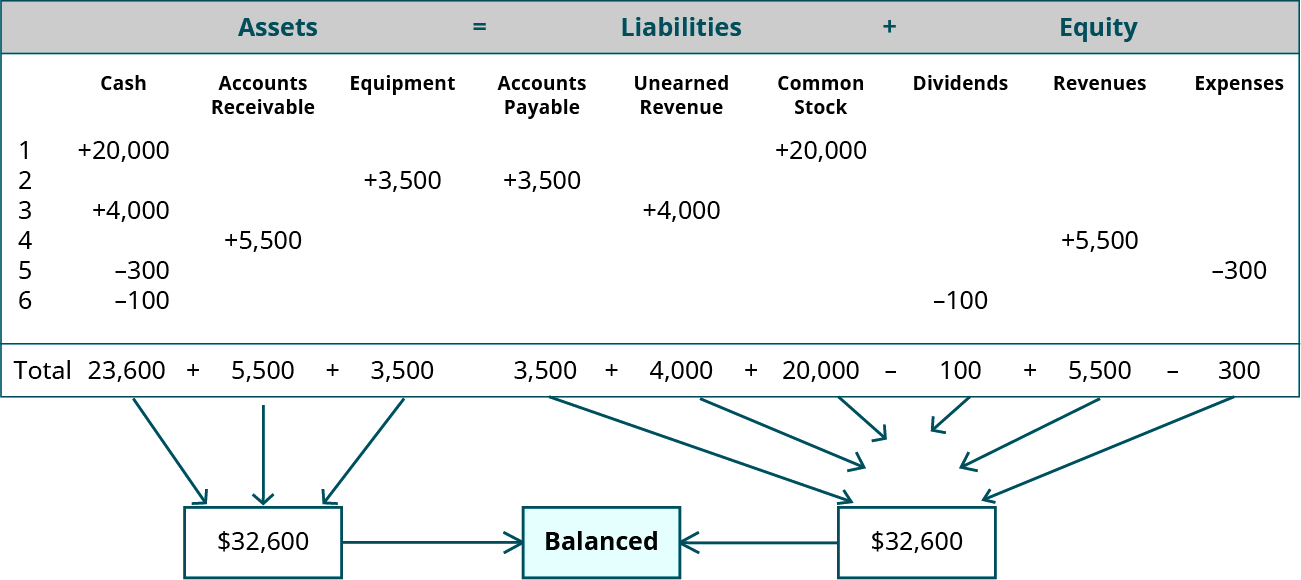

How To Analyze Transactions And Prepare Ine Statement Owner S Equity Statement And Balance Sheet

| Title: How To Analyze Transactions And Prepare Ine Statement Owner S Equity Statement And Balance Sheet |

| Format: PDF |

| Number of Pages: 325 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: December 2021 |

| File Size: 1.3mb |

| Read How To Analyze Transactions And Prepare Ine Statement Owner S Equity Statement And Balance Sheet |

|

Analyzing Transactions Using The Expanded Accounting Equation

| Title: Analyzing Transactions Using The Expanded Accounting Equation |

| Format: PDF |

| Number of Pages: 148 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: June 2020 |

| File Size: 810kb |

| Read Analyzing Transactions Using The Expanded Accounting Equation |

|

How To Determine The Effect Of Transactions On The Basic Accounting Equation Accounting Principles

| Title: How To Determine The Effect Of Transactions On The Basic Accounting Equation Accounting Principles |

| Format: ePub Book |

| Number of Pages: 259 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: April 2018 |

| File Size: 2.3mb |

| Read How To Determine The Effect Of Transactions On The Basic Accounting Equation Accounting Principles |

|

Accounting Equation Problems And Solutions Balance Sheet Equation

| Title: Accounting Equation Problems And Solutions Balance Sheet Equation |

| Format: ePub Book |

| Number of Pages: 188 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: October 2021 |

| File Size: 1.35mb |

| Read Accounting Equation Problems And Solutions Balance Sheet Equation |

|

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

| Title: Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

| Format: ePub Book |

| Number of Pages: 292 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: November 2017 |

| File Size: 2.8mb |

| Read Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting |

|

Analyze Business Transactions Using The Accounting Equation And Show The Impact Of Business Transactions On Financial Statements Principles Of Accounting Volume 1 Financial Accounting

| Title: Analyze Business Transactions Using The Accounting Equation And Show The Impact Of Business Transactions On Financial Statements Principles Of Accounting Volume 1 Financial Accounting |

| Format: ePub Book |

| Number of Pages: 211 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: October 2018 |

| File Size: 3mb |

| Read Analyze Business Transactions Using The Accounting Equation And Show The Impact Of Business Transactions On Financial Statements Principles Of Accounting Volume 1 Financial Accounting |

|

Ncert Solutions For Class 11th Ch 3 Recording Of Transactions I Analysis Of Transactions Accountancy

| Title: Ncert Solutions For Class 11th Ch 3 Recording Of Transactions I Analysis Of Transactions Accountancy |

| Format: eBook |

| Number of Pages: 307 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: April 2020 |

| File Size: 3.4mb |

| Read Ncert Solutions For Class 11th Ch 3 Recording Of Transactions I Analysis Of Transactions Accountancy |

|

The Balance Sheet Debits And Credits And Double Entry Accounting Practice Problems Universalclass

| Title: The Balance Sheet Debits And Credits And Double Entry Accounting Practice Problems Universalclass |

| Format: ePub Book |

| Number of Pages: 135 pages Problem 4 4 Using T Accounts To Analyze Transactions Answers |

| Publication Date: June 2019 |

| File Size: 2.6mb |

| Read The Balance Sheet Debits And Credits And Double Entry Accounting Practice Problems Universalclass |

|

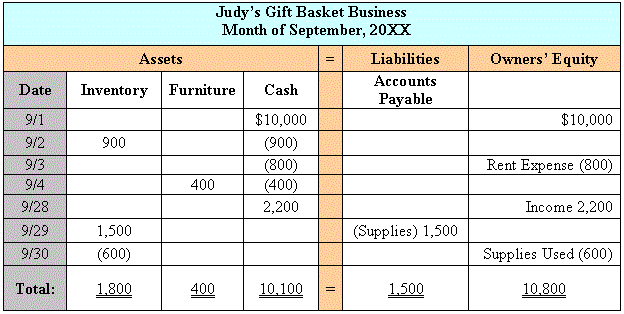

Analyze each of the following transactions. Arial Wingdings Default Design Using T-Accounts to Help Analyze Transactions What you already should know. We have solutions for your book.

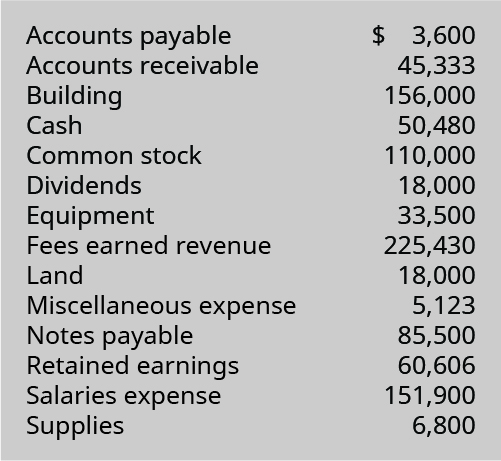

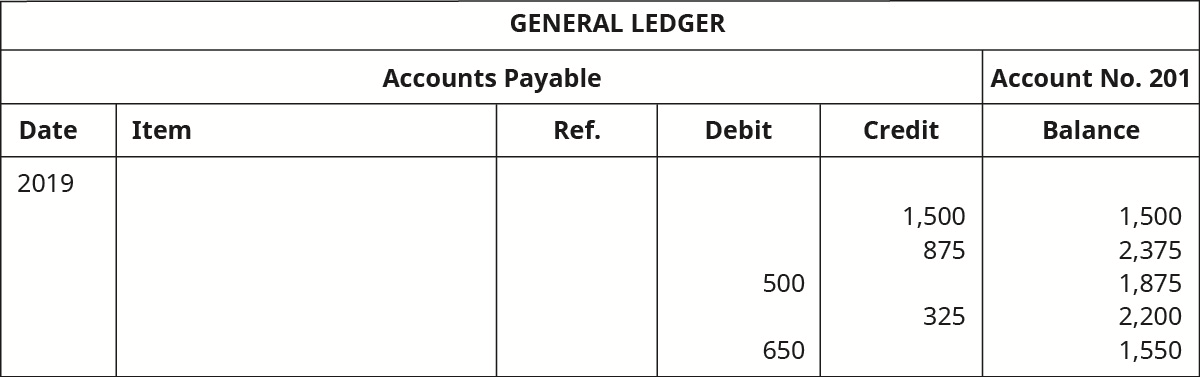

Here is all you need to read about problem 4 4 using t accounts to analyze transactions answers Property and Financial Claims. Deductions to account balances should be indicated by a minus sign 1. In this lesson you will learn what transaction analysis is how to analyze a transaction and how it is related to the accounting equation. Analyze business transactions using the accounting equation and show the impact of business transactions on financial statements principles of accounting volume 1 financial accounting ncert solutions for class 11th ch 3 recording of transactions i analysis of transactions accountancy the balance sheet debits and credits and double entry accounting practice problems universalclass how to determine the effect of transactions on the basic accounting equation accounting principles use journal entries to record transactions and post to t accounts principles of accounting volume 1 financial accounting 4 4 preparing journal entries financial accounting The T account so called because of its T shape shows the dollar increase or decrease in an account that is caused by a transaction.